HLB Connect | Deposit-i | 29 January 2026-08 March 2026

Place an eFD-i via HLB Connect to enjoy these promotional rates

| Effective Date | Tenure | Promotional Rates¹ | Minimum Placement Amount | Maximum Placement Amount |

|---|---|---|---|---|

|

29 January 2026 - 8 March 2026 |

3 months |

3.40% p.a. |

RM1,000 |

Subject to the prescribed max transfer limit of the relevant bank |

| 6 months | 3.55% p.a. | |||

| 12 months | 3.65% p.a. |

¹The Promotional Rate(s) may be revised should there be an Overnight Policy Rate (OPR) change or at the discretion of the Bank with prior notice.

How to place eFixed Deposit-i on Connect Online Banking?

HLB Connect Online

Log in to HLB Connect Online

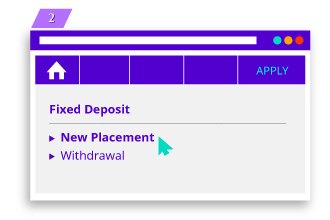

From the Apply menu, under Fixed Deposit, select New Placement

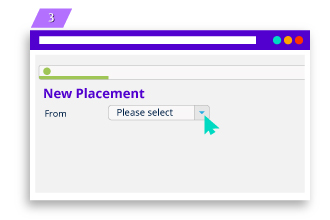

Select your funding bank

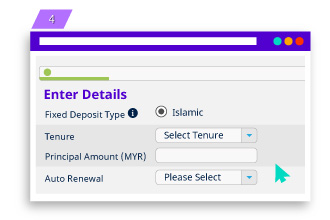

Enter placement details. Under FD Type, select ‘Islamic’

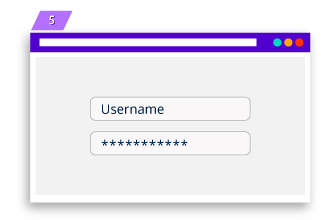

You will be redirected to your funding bank's internet banking login page

Log in and transfer placement funds via FPX

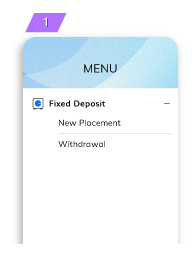

Log in to your Connect App, tap on Menu, Fixed Deposit,

and select New Placement

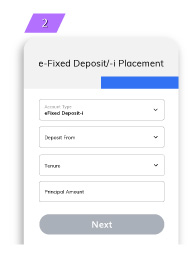

Select eFixed Deposit-i and enter your placement details

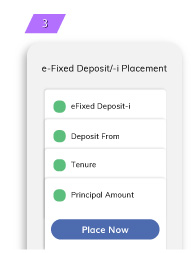

Check your details and tap on Place Now

If you have selected other bank as your funding bank, you will be redirected to your funding bank's page to complete your eFixed Deposit placement

Not yet an HLB Connect user? Register now.

Terms and Conditions apply. Valid for New Funds only.

The maximum deposit amount per transaction via FPX transfer is RM200,000, subject to such prescribed

maximum amount/limit of transfer in the Customers’ individual internet banking maintained with the relevant bank.

Member of PIDM. Protected by PIDM up to RM250,000 for each depositor.